What to Know Before Choosing a New Car Insurance Provider

Getting car insurance might feel like checking a box, but choosing the right provider can make a huge difference when it counts. The way insurance companies handle claims, customer service, pricing, and flexibility has evolved dramatically. For drivers looking to switch or sign up for a new policy, knowing what to look for can ensure long-term satisfaction and financial peace of mind.

Why Experience Matters in Senior Car Insurance Selection

Insurance providers with extensive experience serving senior drivers often offer specialized coverage options tailored to mature drivers’ needs. These companies understand that seniors typically have decades of driving experience and often maintain safer driving habits. Many providers offer specific programs that reward this experience with better rates and additional benefits designed for older drivers.

Key Features to Compare When Shopping for Coverage

When evaluating different insurance providers, seniors should focus on several critical factors. Look for companies offering accident forgiveness, as even experienced drivers can have occasional mishaps. Additionally, consider providers that offer discounts for defensive driving courses, which many seniors take to maintain their skills. Coverage for medical payments becomes increasingly important as we age, so ensure potential providers offer robust medical payment options.

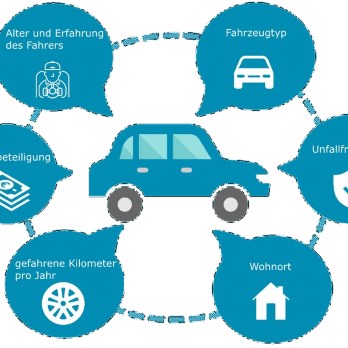

Understanding Cost Factors and Available Discounts

Insurance costs can vary significantly between providers, and several factors influence premium rates for senior drivers. Age-related discounts, low-mileage discounts, and rewards for safe driving history can substantially reduce premiums. Many providers also offer multi-policy discounts when combining auto insurance with home or life insurance coverage.

| Insurance Provider | Senior-Specific Benefits | Estimated Monthly Premium Range |

|---|---|---|

| State Farm | Safe Driver Discount, Defensive Driver Course Discount | $65-120 |

| AARP/Hartford | RecoverCare Coverage, Lifetime Renewability | $70-130 |

| Geico | Prime Time Contract (50+), Multi-Vehicle Discount | $60-115 |

| Progressive | Usage-Based Insurance Option, Small Accident Forgiveness | $75-125 |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Long-Term Coverage Considerations for Peace of Mind

When selecting an insurance provider, consider their long-term reliability and customer service reputation. Look for companies with strong financial ratings and positive customer feedback, particularly regarding claims processing. The best providers offer clear communication channels and easily accessible support services, which becomes increasingly important as technology continues to evolve.

Additional Services That Enhance Senior Driver Safety

Leading insurance providers often include valuable extras such as roadside assistance, rental car coverage, and even transportation alternatives when needed. Some companies partner with auto repair shops to provide guaranteed repairs and lifetime warranties on work performed. These additional services can prove invaluable for senior drivers who want comprehensive support beyond basic coverage.

Choosing the right car insurance provider requires careful consideration of multiple factors, from coverage options and costs to additional services and long-term stability. By thoroughly evaluating these elements and comparing multiple providers, seniors can find insurance coverage that meets their specific needs while providing the security and peace of mind they deserve.